"Pay or Play" Employer Requirements Under Health Reform

Health care reform continues on its course, and employers will soon face newly mandated requirements. Employers should familiarize themselves with the requirements and review their practices now to learn how they can be compliant – and avoid fines. Learning how to evaluate the group membership and the plan structure relative to the employer requirements is the key.

EMPLOYER SIZE

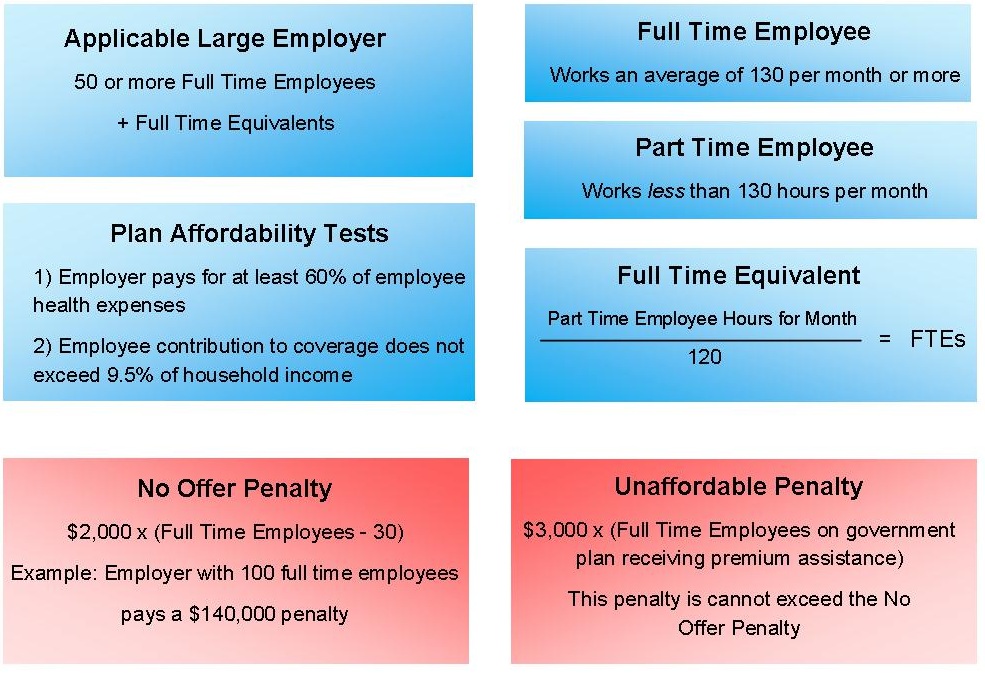

Employers must first verify that the company is an Applicable Large Employer. If a company has more than 50 full time employees or their equivalents, fines and penalties can apply. The first step is to categorize employees as either part time or full time. As defined in this regulation, a full time employee works 130 hours or more per month. A part time employee works, on average, less than 130 hours per month.

The next step is to calculate how many Full Time Equivalents the part time employees represent.

To get the full time equivalents of a company’s part time employees, total the hours of all part time employees for that given month and divide by 120. This will give the part time employee Full Time Equivalents.

The third step is to add the full time equivalents to the number of full time employees. If this number is greater than 50, the company is considered an Applicable Large Employer.

A company must aggregate employees in all affiliate companies; an employer cannot avoid penalties by breaking up a large company into smaller ones. For new companies or employers, the rule is the reasonable expectation of average number of employees in the current year. There is an exception made if a company has a seasonal workforce, with season defined as 120 days, and that season workforce is what qualifies them as a large employer.

TAX CREDITS

For an employer to be hit with a No Offer Penalty, at least one full time employee must be receiving a tax credit from the government. An employer will not pay an Unaffordable Penalty on employees that do not receive tax credits. If an employer has only very high earning full time employees who would never receive premium assistance (the tax credit), this employer is exempt from penalties.

Tax credits are determined by employee household income to family size. The maximum income per household that will receive tax credits are as follows: household size of one is $44,680; household size of two is $60,520; household size of three is $76,360; household size of four is $92,200. Future legislation may lowers these thresholds as some argue they are too high.

If the employer’s state has not taken the Medicaid expansion, there is a possibility that the employer will not have to pay fines on those employees who would receive Medicaid. Medicaid is intended to cover individuals whose household income is up to 133% of the Federal Poverty Line. If the state has not taken Medicaid expansion, some low income individuals could be excluded, thus the employers would not face any fines on these individuals as they are not receiving the tax credit.

AFFORDABLE AND ESSENTIAL HEALTH BENEFITS

If an Applicable Large Employer wishes to avoid a No Offer Penalty, they must offer Affordable Essential Health Benefits to all full time employees (employees working on an average of 30 hours a week or more). Essential Health Benefits must cover: ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, including behavioral health treatment, prescription drugs, rehabilitative and habilitative services and devices, laboratory services, preventative wellness services and chronic disease management, and pediatric services, including oral and vision care. These health benefits must cover dependents.

There are two tests that an employer’s benefit plans must pass to be deemed Affordable. First, an employer’s plan must cover the costs for 60% of the population. Second, any individual employee’s contribution must not exceed 9.5% of that employee’s household income. There is an ambiguity in the legislation as the affordability test has yet to be specified as based upon single or family coverage. A measure of affordability based upon family coverage would make this test much stricter for employers than one based upon single coverage. Basing this measure upon single coverage could prevent dependents of this employee (receiving unsubsidized single coverage) from accessing premium assistance.

FINES AND PENALTIES

If an Applicable Large Employer’s health benefits are not affordable, it will pay an annual fee of $3,000 multiplied by the number of full time employees receiving premium assistance. However, this fine is not to exceed $2,000 multiplied by the number of full time employees receiving premium assistance minus 30.

If a company is an Applicable Large Employer and chooses not to offer coverage to its full time employees, it will pay an annual penalty of $2,000 multiplied by the number of full time employees receiving premium assistance minus 30.

As ambiguities remain, the evaluation process will continue to evolve. A complete list of tax provisions under the ACA is availableHere. Prairie States is monitoring the changes closely and keep our customers informed and compliant.

Prairie States Enterprises, Inc. is a third-party health benefits plan administrator that brings industry expertise and a clinical focus to self-insured companies. Our in-house claims administration, health management services, wellness programs, plan analysis and predictive modeling tools result in remarkable and unprecedented cost control for employers. We also provide the most compassionate and personalized level of service for plan members.